Full process of filling Income-Tax Return online

The income tax department has released the ITR filing

software and online website utility for all seven ITR forms for the FY 2017-18

(AY 2018-19). Out of those only ITR-1 and ITR-4, are often filed completely

online without having to download any software utility in Excel or Java format.

ITR-1 is often filed by resident individuals only having

income of up to Rs 50 lakh. The source of this income should be salary, one

house property, and other sources like interest income etc.

On the opposite hand, ITR-4 are often utilized by those

individuals and Hindu Undivided Families (HUFs) who have opted for the

presumptive income scheme for income earned from business and profession during

the FY 2017-18 undersection 44AD, 44ADA & 44AE of the income tax Act.

This year it's important to file ITR on time as there's a

late filing fees on belated ITR filing.

Using completely online method, an individual can fill the

tax return (ITR) form online by entering the relevant information and at last

submit it online in addition.

This step by step guide will assist you do a similar.

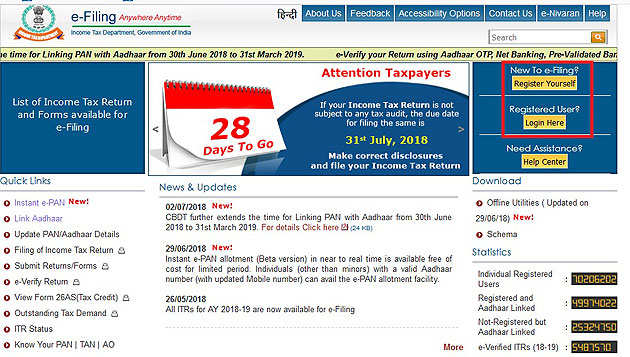

1. Visit the e-filing website: https://incometaxindiaefiling.gov.in/

2. If you're a primary time user or filing your returns for

the primary time then click on the 'New Registration' tab and register yourself

by providing relevant details and creating your profile and password. While

creating your user ID, you need to make sure that you have got an active e-mail

id and mobile number and it's mentioned correctly.

It is important as communication by the department is going

to be sent on

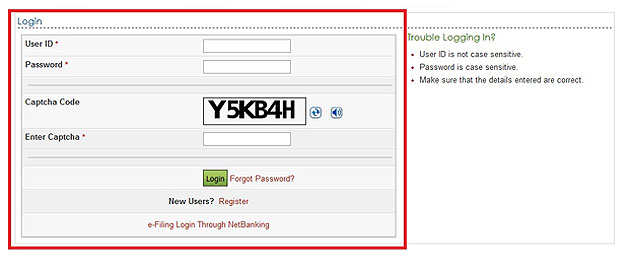

3. Next click on login tab and enter the specified details:

your user ID i.e. your PAN, password and captcha code. Click on log-in button

at rock bottom to sign in.

4. After signing in, your account dashboard will open up as

shown within the picture below. Click on the 'e-file' tab and choose 'Income

Tax Return' option. Please note that the method of filing returns for FY

2017-18 has been changed by the tax department as compared to it used for

filing returns for FY2016-17 in 2017. Therefore, screenshots are updated to

indicate a similar.

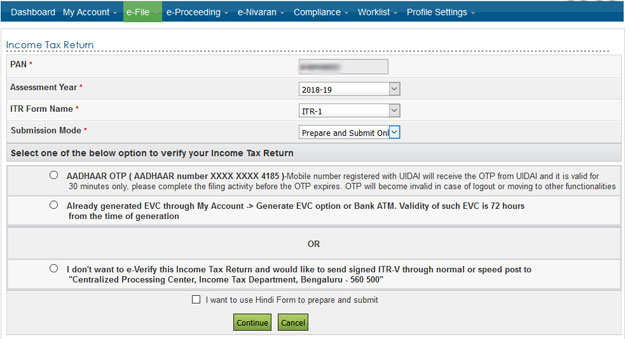

5. Now, let us select the assessment year, i.e., 2018-19,

relevant form i.e. ITR-1 or ITR-4 and submission mode, make ready & submit.

Click Submit button. For example, screen shots of ITR-1 are given below.

Here you'll even be required to pick the choice to verify

your returns Three options are given to verify your returns: a) Via Aadhaar OTP

(valid for 30 minutes), b) Generated EVC option through My Account or Bank ATM

(Valid for 72 hours) or c) by sending signed copy of ITR-V to Centralized

Processing Centre, tax Department, Bangalore -560500.After selecting one among

the choice , click on submit. you furthermore may have an choice to fill your

ITR form in Hindi. Click thereon button before clicking.

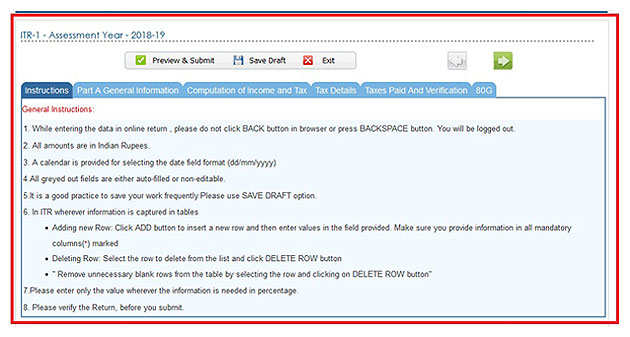

6. The web site will redirect you to the page for filling

the shape as selected by you. Before beginning to fill the ITR form, one should

read the 'General Instructions' given at the beginning of the shape to

understand do's and don'ts.

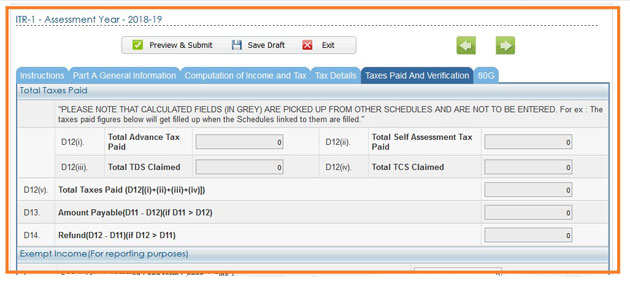

7. afterward you may be asked to fill in required information in several tabs i.e. 'General information', 'Income details', 'Tax details' 'Taxes paid and verification' and '80G' within the ITR form. One should make sure that the Tax payable shown within the online form matches your calculations.

7. afterward you may be asked to fill in required information in several tabs i.e. 'General information', 'Income details', 'Tax details' 'Taxes paid and verification' and '80G' within the ITR form. One should make sure that the Tax payable shown within the online form matches your calculations.

8. Before making the final submission, it's advisable to

save lots of the info entered and recheck it to avoid any mistakes. Once

'Preview and submit' button is clicked, your form will appear allowing you a

preview of your ITR form before final submission is formed.

9. Once you hit 'Submit', your ITR are going to be uploaded and you'll be asked to verify your return using any of the choices available

9. Once you hit 'Submit', your ITR are going to be uploaded and you'll be asked to verify your return using any of the choices available

10. For FY 2016-17, individuals had the choice to submit

their ITR using their digital signature. they might select the choice to digitally

sign their ITR while submitting information of ITR form using which they want

to file their return. However, for FY 2017-18, this feature doesn't show on the

e-filing website once you submit an equivalent information.

11. you'll check your return either electronically using the

Aadhaar One Time Password or E-Verification Code method or by offline method of

sending a signed print out of the ITR V to CPC, Bangalore in duration of 120

days from the date of e-filing.

12. An Acknowledgement/ ITR V are going to be simultaneously

sent to you on your registered email once your return is successfully uploaded.

This acknowledgement also will show up in your account on the e-filing website

from where you'll download it if required.

13. The department will process & check your ITR once

you verify it. After your ITR is processed, you'll be intimated about a similar

via email and SMS on your registered mobile number.

Comments

Post a Comment